DEOCA Infrastructure

News & Events

LATEST NEWS

Photo

Video

HHV General Meeting of Shareholders: Increase capital to over 3,500 billion dongs and move listing at HOSE

- 26/04/2021

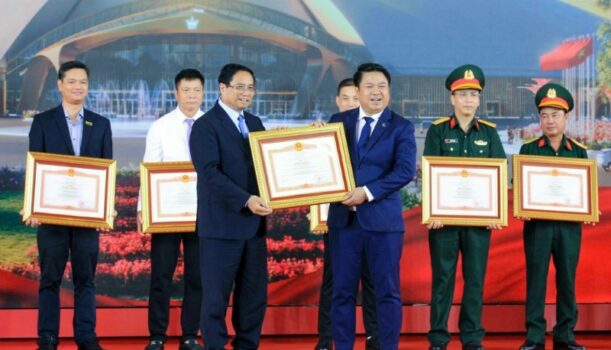

On April 26, Deo Ca Traffic Infrastructure Investment Joint Stock Company (UPCoM: HHV) held the 2021 Annual General Meeting of Shareholders and was approved by shareholders to increase charter capital by nearly VND 860 billion through issuance of private shares for debt swap and shares to existing shareholders. The company also plans to move the list on HOSE in 2021.

The Plan to raise charter capital and move listing on HOSE

At the meeting, HHV’s Board of Management submitted and approved by shareholders to increase charter capital to 859.5 billion VND. In which, issuance of private shares for debt swap accounted for nearly 271 billion dongs and issuance of shares for existing shareholders accounted for nearly 589 billion dongs. Charter capital is expected to reach over VND 3,533 billion after two times issuances.

For the first option, HHV plans to issue more than 27 million shares to swap debts (debt swap ratio is 10,000 VND: 1 share) for Northern Infrastructure Investment JSC and Deo Group JSC. It is expected that after the issuance, these two shareholders will own 40.44% of the capital in HHV. More than 27 million shares issued to swap debt will be restricted transaction at least 1 year.

Besides, HHV shareholders also approved the plan to offer nearly 59 million shares to existing shareholders at the ratio of 5:1. The Board of Management of HHV has decided the offering price for existing shareholders and not lower than the par value. The total amount raised will be used for the business and investment activities of the Company.

Another remarkable report also approved by shareholders is the moving of stock exchanges. BOM stopped listing on UPCoM and registered to list on Ho Chi Minh City Stock Exchange (HOSE). The expected completion date is in 2021.

HHV did not have many transactions on UPCoM, the average trading volume over a year was at 300 shares/session. In the morning session of April 23, HHV closed at 19,500 dong/share.

Profit after tax in 2021 is estimated to grow by 23%.

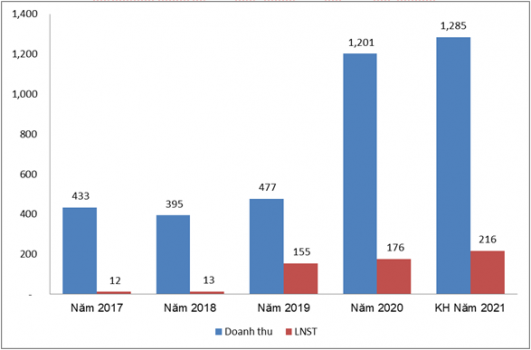

In 2020, the Board of Directors of the Company has focused on finding solutions to remove difficulties and well implement production and business activities. Accordingly, HHV’s revenue recorded more than 1,200 billion VND, of which revenue from traffic tolls accounted for 78%, equivalent to 938 billion VND; construction accounted for 11%, earning 139 billion VND; The rest are maintenance, other business…

Overall results, HHV achieved a profit after tax of more than 175 billion VND, an increase of more than 13% compared to the previous year.

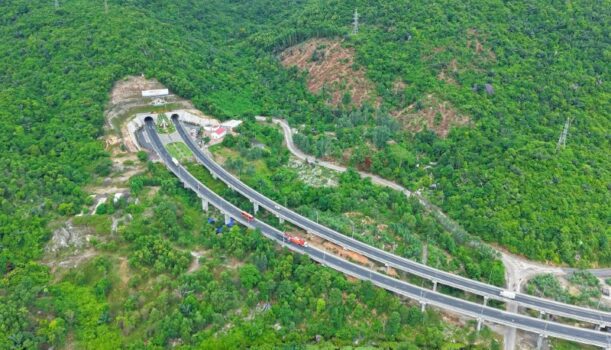

In 2020, HHV spent more than VND 637 billion on long-term investments in projects. In addition, the Company has also completed the construction of bidding packages under the Hai Van Tunnel 2 project. This project has been accepted and put into operation by the State. This is the last major part of the Deo Ca tunnel project with a total investment of more than 21,600 billion VND.

Regarding the business plan for 2021, HHV estimates revenue around VND 1,285 billion, up 7% compared to 2020. Profit after tax is estimated to reach VND 216 billion, up 23%. The dividend is expected to be distributed at the rate of 10%/charter capital.

Business results from 2017 and HHV’s 2021 plan (Unit: Billion VND)

This year, HHV intends to increase investment in traffic infrastructure projects, in addition to completing and restructuring the company. The company will not pay dividends in 2020 to add up capital for investment, production, and business in the coming time.