DEOCA Infrastructure

News & Events

LATEST NEWS

Photo

Video

HHV has many advantages in PPP projects, its stock is recommended by economic experts to invest.

- 20/07/2021

Assoc. Prof. Dr. Tran Dinh Thien, former Chief of the Vietnam Institute of Economics, said that mobilizing social resources through the issuance of bonds and shares from a reputable company to invest in traffic infrastructure projects in the form of public-private partnership (PPP) is a necessary solution in the current situations.

Investing in traffic infrastructure in the form of PPP using state budget, investor capital, and other mobilized capital is a solution to reduce the burden on the State budget, making an important contribution to improving the efficiency of economic development – country society. From the perspective of an economic expert, please Assoc. Dr. Tran Dinh Thien shared his opinion on how to diversify the mobilized capital sources in PPP investment projects in general and traffic infrastructure PPP projects in particular?

Assoc. Prof. Dr. Tran Dinh Thien

Around the world, investment in the form of PPP (public-private partnership) began in the 1990s. PPP capital mobilization is widely deployed, regardless of the bank.

In Vietnam, the form of PPP investment in the field of traffic infrastructure has developed strongly in the past 10 years, mainly in the form of BOT (build – operate – transfer) investment. For PPP, in addition to capital from the State budget and capital from private investors, capital mobilized from society plays an important role. In fact, in our country nowadays, investors in traffic infrastructure still think about using credit loans as the main source of mobilization for investment in the form of PPP. This approach has strict limitations. It makes investors, and also the company, dependent on commercial banks, while these banks themselves, with limited financial capacity, are under pressure to lend a huge amount of capital.

We know that a traffic project needs to mobilize a very large capital, the payback plan lasts for decades. Recently, commercial banks have repeatedly said that they do not give priority to long-term loans. They continuously broadcast the message, limiting the loan limit in the BOT form when the safety factor has been reached.

Therefore, it can be seen that the Government’s encouragement of investors to seek other capital mobilization options outside banks to solve the capital problem (Decree 28/2021/ND-Government) has great positive worth. That capital can come from financial institutions, organizations, and individuals from domestic and overseas…. through business cooperation contracts (BCC), bonds, etc.

Currently, Deo Ca Traffic Infrastructure Joint Stock Company is implementing procedures to move the listing on the Ho Chi Minh City Stock Exchange (HoSE) to attract capital from private investors and funds to invest in traffic infrastructure projects. I think this is a very hopeful capital mobilization solution, opening up opportunities to promote investment in traffic infrastructure in the context of increasingly difficult credit capital.

Assoc. Prof. Dr. Tran Dinh Thien, former Chief of the Vietnam Institute of Economics

HHV is a rare “bright spot” on the stock market and taking great attention from investors. Could you please give your opinion on the decision of a traffic infrastructure investment company to list on the Ho Chi Minh City Stock Exchange? with the target of raising capital to implement highway projects in the form of PPP?

Assoc. Prof. Dr. Tran Dinh Thien

Mobilizing social financial resources from issuing bonds and stocks if the issuer is a reputable company is a highly feasible solution. The matter is in the issuer’s ability to ensure benefits for securities investors.

HHV is one of the top private BOT investors in the country. It owns a series of companies – projects such as Deo Ca Investment Joint Stock Company, Bac Giang – Lang Son, Deo Ca – Khanh Hoa, Phu Gia – Phuoc Tuong, etc. successful project, not only economically but also financially. This can be seen through the information that has been audited and published on the stock exchange.

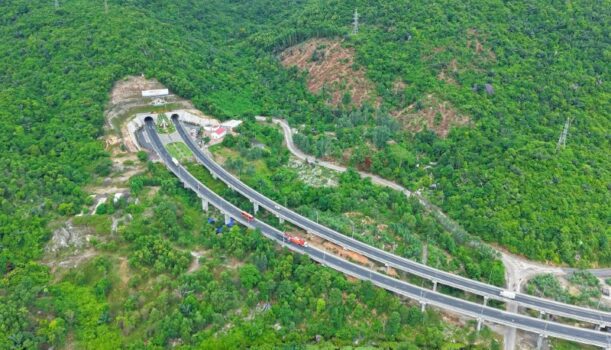

After a series of successful large projects such as tunnels through Ca pass, Cu Mong, Hai Van, Bac Giang – Lang Son expressway, HHV and its parent company, Deo Ca Group, are researching and investing a series of new projects such as Huu Nghi – Chi Lang, Dong Dang – Tra Linh, Tan Phu – Bao Loc, Van Phong – Nha Trang highways, and highways in Binh Dinh, Phu Yen, Khanh Hoa provinces… with a total investment amount of about 100,000 billion VND. Currently, I know that many provinces invite Deo Ca to research, consult traffic infrastructure investment projects according to the Government’s policy of decentralization of powers for local authorities.

The demand for investment in traffic infrastructure is huge. The prestige of Deo Ca is being confirmed. I think listing on HoSE is a necessary step for HHV to improve its financial capacity, enhance transparency, and strengthen its brand in the market in the future; is the premise for HHV to choose strategic investors.

HHV in particular and Deo Ca Group, in general, are enjoying effective governance in the Vietnamese business community, and at the same time having an international reputation. Some foreign investors are looking to cooperate with HHV and Deo Ca. The listing on the stock exchange will create motivation for HHV to continue promoting corporate restructuring towards an intensive – optimal management model, with the strategic goal of becoming a joint-stock company with multiple ownership. I think this is a transformation that should be strongly encouraged. It helps our country have more strong an enterprise, rise up in the competition with the world.

How do you evaluate the potential of HHV when listing on HoSE?

Assoc. Prof. Dr. Tran Dinh Thien

As far as I know, HHV is currently investing directly in 5 major traffic infrastructure BOT projects, including Phuoc Tuong – Phu Gia, tunnels through Ca, Cu Mong, Hai Van, and Bac Giang – Lang Son expressway, Deo Ca – Khanh Hoa highway. These projects have all gone into stable fee collection, ensuring revenue to repay debts on time, balancing capital sources for other business activities.

Hai Van Tunnel – The longest tunnel in Southeast Asia invested, constructed, and operated by HHV.

With 78% of revenue from toll collection on key traffic routes, it is reasonable to believe that HHV will continue to bring stable revenue and profit to investors. I think HHV has good conditions to improve its profit margin in the near future because after the project is put into operation, interest expenses as well as other operating expenses will gradually decrease.

HHV has an exclusive strength in the field of road tunnel exploitation and operation and is leading in the construction contractors of traffic infrastructure projects. Listing on HoSE not only helps HHV diversify its mobilized capital sources to solve capital problems in the short and medium-term but more importantly, increase its potential and create strength to thrive in the future. This is the strategic target of stock investors.

Thank you, Sir!

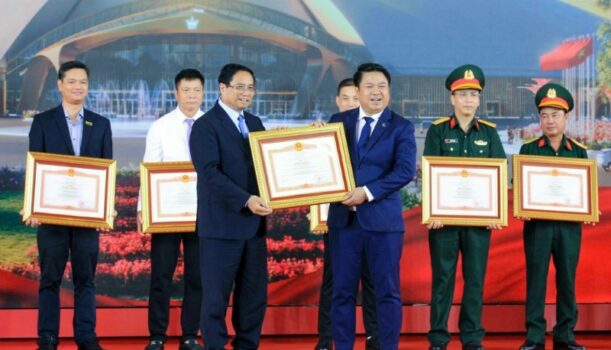

HHV is a unit under Deo Ca Group – a leading private group in Vietnam in construction investment, management, and operation of traffic works. The Group has completed many large and difficult traffic projects with good quality and ahead of time. Currently, HHV is proposing to research and implement many traffic infrastructure projects in PPP, with particularly strong and reliable commitments in terms of costs and benefits.

BY ANH DUONG

Nguồn: toquoc.vn